This article was originally published on MuirEdison.com and was migrated when Muir Edison became a Breakthrough brand.

Key Takeaways:

- Expect to gain an understanding of 3 strategic marketing approaches: Transactional, relationship, or expertise marketing.

- Understand where your firm falls on this spectrum

- You may decide to revisit your firm’s overall strategic plan in order to: be more impactful for your clients, make better use of your time, to better empower your advisor team, your marketing dollars and more.

Selecting Your Marketing Approach: Transactional, Relationship, or Expertise Marketing?

Why Your Marketing Approach Matters

Clients have been asking us since the early 2000’s (back when yellow pages were still in use): What is the hot new marketing tech or strategy?? What am I missing out on? Where should I be investing my marketing dollars?

So to answer that: You should absolutely be up to date on the newest marketing tech, but after nailing down your positioning,your marketing approach will be the single greatest marketing decision you will make, and strategy you will follow.

Jeff Bezos asked Warren Buffett: “Warren, your investment thesis is so simple, and yet so brilliant. Why doesn’t everyone just copy you?”

Warren responded: “Because no one wants to get rich slow.”

What is a strategic marketing approach?

Your strategic marketing approach is how you execute your growth and marketing as a function of your firm’s overall strategic plan.

Yourstrategic marketing approach is the fundamental ‘why & how’ for all your marketing activities, and it would flow organically, directly from your firm’s positioning. And make no mistake, everything a client or prospect sees, reads, hears, experiences, feels in reference to your firm – this is all part of your marketing.

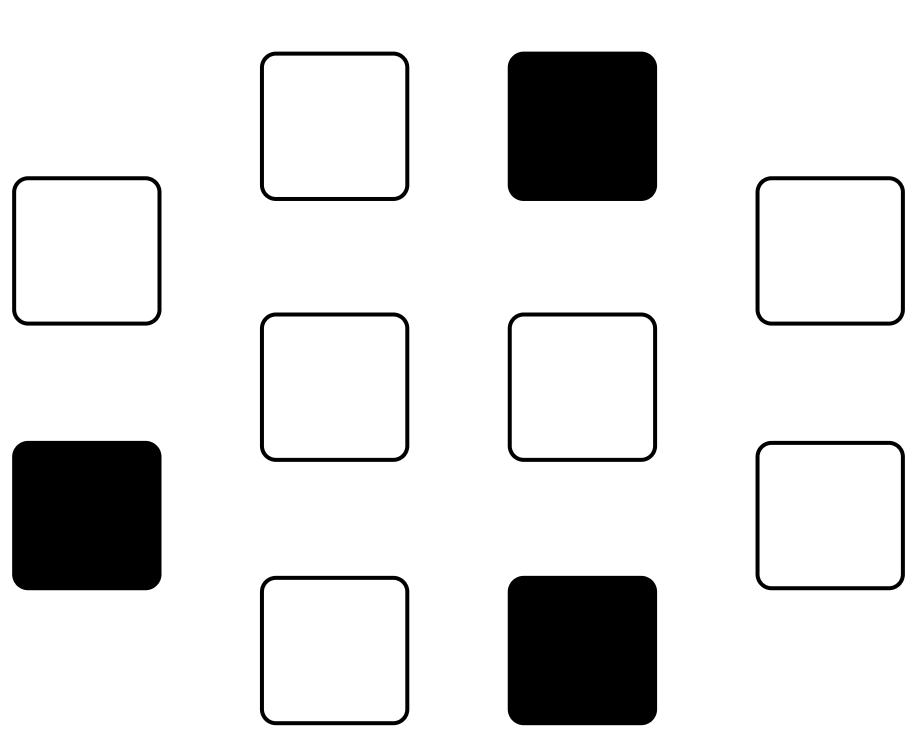

In this article, we will detail 3 strategic marketing approaches that Financial Advisor firms may use: Transactional Marketing, Relationship Marketing, and Expertise Marketing. I will cover: strengths & weaknesses of each, costs, ROI, example channels/implementations, the client relationships you can expect to get from each approach, and more. The goal is to provide you insight into the approach you’re currently taking, and how to improve it.

When should I make this decision?

You would make this decision at one time, as part of your firm’s strategic plan; and this will affect how you operate day to day, how the firm grows, your marketing spend, how the firm’s advisors market themselves, their community activities, their writing, executive presence, all of your communication w/ clients and prospects, process, tech, etc, etc.

You would not revisit this decision week to week, or month to month, this would be a higher level decision you make and then implement organization-wide over the long term.

That said, I do recommend you address (or revisit) this every 4-6 months to both optimize your firm’s positioning, and ensure you’re not getting stuck in the weeds on any particular channel, or habit.

Approach 1: Transactional Marketing

Characterized by:

Quick-fix / Needs-based: Client has an immediate need (advisor help), your firm has a need (new business). You are ready to fix, they are making their decision based on that need and your cost (primarily). Sometimes referred to as ‘outbound’ or ‘outreach’ marketing – you are reaching out to a prospect (vs them seeking out and finding you).

Prospect Journey Example:

A senior business executive changes careers, and cannot carry his 401k to the next company, so he needs to roll it over. While searching for 401k plan rollover services on Google, he sees a big display ad for “XYZ Partners – Investment Advisors”, and clicks on that.

Examples of Transactional Marketing by Financial Advisors:

- Mass Ads / Campaigns (TV, radio, digital, social media, mailers, newspaper, etc)

- Web – Basic site simply promotes name / services

- Email Newsletter – Promoting firm or services

- Social media – Announcing your brand / services

- Discounts! Promotions!

- Directory Sites (feeonlynetwork.com, smartasset.com, yelp)

- Cold Calls, Cold Emails

Timeline / Sales Cycle & Costs:

- Timeline / Sales Cycle: Fast. Designed to get sales immediately. Prospect is typically making a decision on the spot (or within minutes/days primarily). Usually ‘turns on’ with dollars (or effort) spent, and ‘turns off’ when spending stops.

- Cost (Effort, Money & Stress Cost): For the short term, this could be considered the ‘cheapest’ marketing approach (cheapest immediate spend / effort / stress), but for the long-term, this is the most expensive. Client turnover is the highest, and cost to maintain the relationship is high. You are interchangeable in their mind. The foundation of the relationship is weak. If they find a better deal, a close relationship, or a better solution, they will take it.

Results:

- Expected ROI: Low (on it’s own), and requires one of the other approaches to have long-term ROI.

- Relationship Depth: Low

- Trust / Credibility / Authority Applied to You: Low. Client has decided to go with you based on dollars, or ease of access, which means minimal credibility, and just as easily as they made this decision, they can make another.

Approach 2: Relationship Marketing

Characterized by:

The focus is on creating, or sustaining a relationship between you and a client/prospect. If all goes well, a sale is a natural progression of the relationship, but a quick sale would not be the goal here – the goal is to make and cultivate your relationship. The relationship is cultivated usually by seeing, or being with that person, or communicating in some physical/digital way. Your presence is required physically / digitally for this type of marketing.

Client Journey Example:

At a local country club, you play on a regular league. Over time you develop closer relationships with the other members, and you get closer to most of the group. Soon you naturally provide your services to a few of the group and they’ve recommended you to their friends.

Examples of Relationship Marketing by Financial Advisors:

- EMPATHY: Helping / caring for / enjoying time with others in personal or professional settings

- Networking

- Taking clients out to lunch

- Attending local events

- Hosting client events

- Centers of influence (COI) and local partnerships

- Hosting webinars / seminars

- Community – Donations / sponsorship / volunteering

- Client Communication (could be written, spoken, video, audio, etc)

- Speaking at a local event / group

- Web – a higher level than transactional web (A digital client experience with integrated growth platform)

- Email – Personal check-ins, personal service, scheduling get together / help, etc

- Marketing automation to enrich/cultivate relationships

- Indirect (These are not direct relationship strategies, but would be needed for the best possible experience for your relationships):

- Office upgrades to bring people together

- Client Service (or Client Experience) Systems / Processes

- Upgrading your brand / stationery / collateral (to have a more personal touch)

- Upgrading your web / digital growth platform (to have a more personal touch)

- Executive Presence (covered more under Expertise Marketing Strategies below)

Timeline / Sales Cycle & Costs

- Timeline / Sales Cycle: Medium to Long (Average: months to years). Ongoing, regular activities required to continue to cultivate relationships, and establish new ones.

- Effort Cost (Time): Medium to High (1 hour to 8 hours a day, depending on your network growth goals).

- Dollar Cost: Medium (Could be free (helping at a local non-profit, taking a potential COI partner (eg banker) out to lunch), minimal cost (joining a country club), or high cost (Registered speaker at a conference, or small high end gathering).

- Emotional Cost (Stress): Medium, depending on how much relationship building you need (and how your personality matches up with this approach). Effort & input required is directly proportional to network growth requirements.

Results

- Expected ROI: Medium. Relationships can be very powerful, but you are only one person, you can only do so much, and if your approach is relationships without the expertise, you will lose out if the relationship weakens in any way.

- Relationship Depth: Good. Client is choosing based on how they feel about ‘you’ as a person, their intuition, a shared struggle, or trust in a shared relationship (personal referral from personal / professional network or COI).

- Trust / Credibility Level Applied to You: Medium. Better than transactional, but weaker than Expertise. If an advisor comes along who’s better at solving the client’s problems than you (more of an expert), you will lose the client.

Approach 3: Expertise Marketing

Characterized by:

The focus is on impact, specifically becoming an expert in order to solve a problem better than has been done before. Experts want to improve the human condition by better understanding it. Experts have chosen a particular positioning (they aren’t everything to everyone). In doing so, they are taking a risk and they often provide true innovation. Some similarly related (but not the same) descriptive topics to expertise positioning would be: becoming a specialist, differentiating, or choosing a niche. (There is a fundamental difference though to putting a stake in the ground w/ positioning vs just segmenting or targeting niches).

Benefits of Expertise Marketing

- Are in higher demand

- Make their own schedule

- Charge more than a generalist

- Spend less time courting new or existing clients

- More about positioning

Client Journey Example:

I will include an example here – but before you continue, keep in mind: This is a very specific, very tight positioning – As a firm currently in operation, you don’t have to make as drastic a change, be this tight, and you don’t have choose this type of positioning (vertical), there are many other possible ways to position that don’t require an entire re-envisioning of your firm (see Types of Advisor Positioning/Niches below), this is just an example of a very tight, effective positioning:

Example Positioning – RAA positions itself as follows:

Our entire approach to financial services is built around the needs, concerns, and desires of the airline community.

As a generalist Financial Advisor, if you get a call from an airline pilot, you can see it would be difficult to provide the same level of service as RAA (Now you might, eventually provide a similar level of service as RAA, but you just wouldn’t have the industry knowledge, the contacts, the ease of referrals, the unique marketing & sales tactics, the awareness of what’s to come, etc. They have specific offerings by the individual airline! Just imagine the number of problems they’ve solved, the things RAA has already seen, and already knows to prepare for given all the pilots they’ve worked with).

Other Expertise Positioning Examples:

- Pre-retirement Educators (Professors / teachers) based in New York state (Lee E. Kalin & Associates)

- Overseas American’s, non-Americans living in US, those w/ multiple nationalities (White Lighthouse)

Examples of Expertise Marketing by Financial Advisors:

- SEO / Writing / blogging / video / youtube / podcast / seminar / webinar – Designed to help your audience only (expertise & positioning-based content)

- Guest posting in (your audience’s) trade / industry publications

- Speaking at your audience’s industry events / conferences

- White paper / eBook

- Book

- Co-Author a Research Study

Timeline / Sales Cycle & Costs

- Sales Cycle: Varies (Sales can be quick, and can take years)

- Effort Cost (Time): Seemingly high initially, reduces over time as your impact and proprietary process grows substantially, and you become less and less interchangeable.

- Dollar Cost: Low dollar cost, but med to high effort. Time investment in the beginning could be considered high, but will either decrease over time (as ROR / impact / interchangeability decreases). *Also note – Both Transactional & Relationship Marketing activities would be reduced significantly over time; as you begin to ‘create’ for the future, your other marketing transitions to Expertise-based.

- Emotional Cost (Stress): Lowest long-term compared to Transactional & Relationship

Results

- Expected ROI: Highest. High exposure (among target demographic), high impact of all sales & marketing, proprietary processes, products, and services, and more (See Benefits above)

- Trust / Credibility Level Applied to You: The Highest. Assuming your team’s client service covers the basics, you are an expert, so you will have the highest level of credibility afforded.

Choosing a Marketing Approach

This decision should be one you make as part of your firm’s overall Strategic Planning process, and after you think through your positioning, and there are a host of factors you should consider when deciding your marketing approach.

Some questions you can ask yourself to help begin to think about the approach that fits you best:

- How soon do you need the new clients? (Immediacy)

- Personality profiling (for you and your advisor team) taking into account: Talents, Interests, Strengths, Weaknesses

- Do you like writing?

- Do you like Reading / learning or would you prefer hands-on?

- Introverts / Extroverts?

- Like meeting with people regularly? Speaking to groups?

Your firm’s approach could be heavy on 1 approach, or it could be a mixture of the 3 approaches, and this allotment will hopefully shift over time.

My hope for you all is that you are sitting closer to Relationship Marketing (over Transactional), and you’re interested in moving the ‘average spend’ needle closer to Expertise over time. Whatever you decide, I’m excited to see what it is,

Kind regards,

Ti